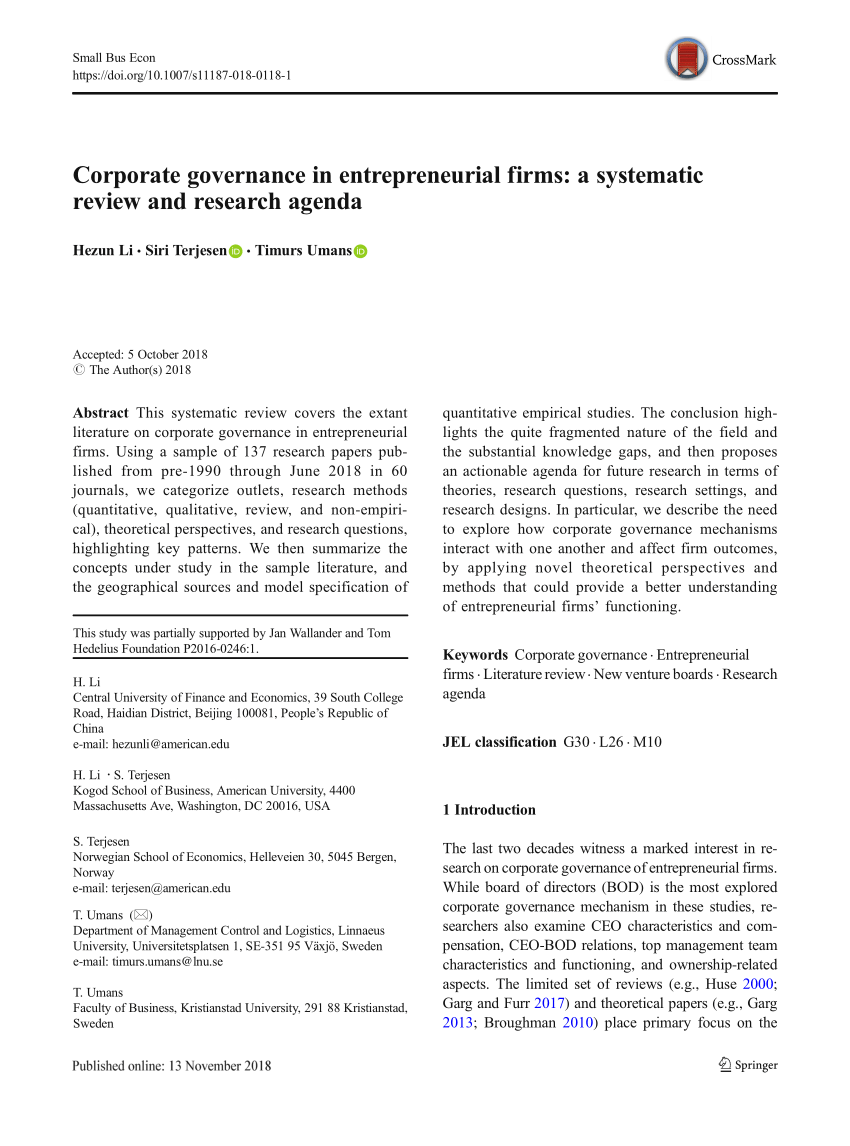

Therefore, in the review procedure of IPO applications, attention should be paid to whether the “three types of shareholders” are in compliance with the guiding opinions.

Ipos 5 siri series#

The People’s Bank of China’s Guiding Opinions on Regulating Asset Management Business of Financial Institutions (also known as the new regulation on asset management), provide a series of rules on the regulated operation of financial products, including the “three types of shareholders”.

Ipos 5 siri registration#

In the author’s view, the issue should be considered from two perspectives: Whether the filing and registration procedures required for both “three types of shareholders” and their supervisors have been carried out and whether “three types of shareholders” are in compliance with the regulatory requirements.

Ipos 5 siri verification#

The author would like to draw on his recent project experience in combination with regulatory requirements to present the difficulties in the verification requirements of conventional “three types of shareholders” in IPOs, and share a bit of experience in this respect. Fortunately, however, the guidelines on shareholder verification and disclosure still leave room for exemption applications for the “three types of shareholders” participating in call auctions. With the introduction of the guidelines, the shareholder verification requirements have become more detailed and stringent than ever before. On 5 February 2021, the CSRC issued the Guidelines on the Application of Regulatory Rules – Disclosure of Information on Shareholders of Companies Applying for IPOs, requiring disclosure on whether shareholders (financial product) are registered under governmental agencies’ data bases or not.įollowing the introduction of the above-mentioned guidelines, Shenzhen Stock Exchange, for example, has imposed further verification requirements where intermediaries are required to carry out a series of verifications including the issuer’s direct and indirect shareholder eligibility of holding shares in a company, and whether there is any transfer of benefits by using the shares they hold in the issuer. In June 2020, the China Securities Regulatory Commission (CSRC) issued the Questions and Answers on Initial Public Offerings (IPOs), which set out express requirements for the verification and disclosure of information on “three types of shareholders” who become shareholders of issuers during their listing on the National Equities Exchange and Quotations (NEEQ, also known as the New Third Board). Three positions, “Siri - iOS Engineer” has three replicated openings.The term, “three types of shareholders” refers to financial products such as contractual-type private equity funds, asset management plans, and trust plans, usually excluding partnership funds or corporate private equity funds.

Ipos 5 siri software#

When it came to the patterns in the job titles, the most common title is “Siri - Software Engineer”, of which there are five positions. Of the 161 openings, 125 are based there, the data showed. The job openings are largely based at Apple’s new headquarters in the Santa Clara Valley. “This marks a jump in hiring for the keyword of 24 per cent in just over a month,” Thinknum, a web platform that allows investors to get data driven investment ideas by monitoring companies’ websites, said late on Saturday.

According to the data accumulated by Thinknum, the number of open positions that contain the term “Siri” has accelerated in recent weeks, with a current all-time high of 161 job listings posted on Saturday alone.

To augment the experience between a user and its Artificial Intelligence (AI)-powered virtual assistant Siri, Apple has posted several job openings for engineers at its different offices globally.

0 kommentar(er)

0 kommentar(er)